Mission: To Educate & Protect the Policyholder

Mission: To Educate & Protect the Policyholder

Policy Review: An insurance policy is often purchased to protect the lender as a requirement when a home is bought. A business insurance policy is bought in order to protect and maintain the financial health of the business. When was the last time you read to see what is actually covered in these policies?

Contact D. Nicklus toll free 1-800-251-0746, Licensed and Bonded Advocate for property owners. Waiting for the time you need to learn what’s truly cover is too late. Educating the policy holder with a policy review is important. We conduct policy reviews so when a claim occurs owners’ have information needed for the claims process to go smoothly as possible.

Perils occur suddenly and accidentally. When you experience a loss covered by your Property Insurance Policy, its your primary obligation to report the loss and your duty prove your loss. Owners need to make the damaged property available for inspection by the company. What is said and what you may do impacts how your cl aim will be handled by the insurance company and will effect how you will be paid.

aim will be handled by the insurance company and will effect how you will be paid.

Educating the policy holder with a policy review is an important part of the public adjuster's role as the property owner's advocate. The policy review brings an awareness to what a policy actuality covers.

The insurance policy terms require the owner prove their loss. It is the owner's responsibility. Public adjusters assist owner's meeting this requirement assuring the owner's interest are being addressed.

1st Property Public Adjustment has a staff of structural engineers and other experts to manage a claim for payment that enables the owner to restore property to its prior state. Insurance company adjusters work for the insurance company.

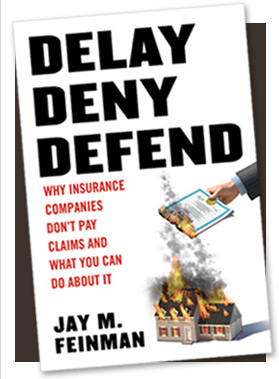

Jay Feinman, author of Delay, Deny, Defend, points out that “The company delays payment of a claim, denies all or part of a valid claim, or aggressively defends the insurance company's non payment to policyholder of what they are rightfully owed.” Public adjusters work for the policy holder adjusting owners damage claims.

Jay Feinman, author of Delay, Deny, Defend, points out that “The company delays payment of a claim, denies all or part of a valid claim, or aggressively defends the insurance company's non payment to policyholder of what they are rightfully owed.” Public adjusters work for the policy holder adjusting owners damage claims.

The Insurance company knows that the home owners do not have the knowledge required to prepare valuations for a claim. This is why using a licensed public adjuster has become more important today.

When insurance doesn't work, the consequences are more severe than when any other kind of company fails to keep its promise. If the insurance company refuses to pay a claim, it is too late to go elsewhere for another policy; no company will write a policy or pay for fire damage that had already occurred after a fire.

To learn whats in your policy call 1-800-251-0746 for an appointment..

Company adjusters minimize your damage by encouraging cost savings methods.

1st Property Public Adjustment is your best line of defense. Don't accept less than what you are entitled to! 1st Property Public Adjustment will get you the highest possible settlement for all your insurance claims. Whether your property is residential, commercial, or a vacation property, We will negotiate the maximum settlement possible.

Reasons To Use a 1st Property Public Adjuster.

Maximum Settlement

Policy review and explanation

Computer claim tracking

License and Bonded

Reputation (Founded in 1993 )

On going training

Full Company Staff & Legal Support

Industry Standard Estimate System (xactimate)

Our BBB (A+) rating

Temporary housing

Fire & Smoke Expertise

Customer Service

Protect Homeowners Rights

Adjuster support staff

Proper claim presentation (1st 10 mins are critical)

Identify future issues

Provide certified estimate

Claim presentation support

Provide emergency service support

Cutting Edge of Industry knowledge

Industry relationship.

Resources of the Largest Public Adjustment Firm

Property Inspections and what are you against when submitting a claim by yourself.

When you submit a claim, you have to deal with a very experienced insurance company adjuster who is thoroughly trained in all aspects of minimizing your damage. Keep in mind that it is the homeowner’s responsibility to point out the damage, not the insurance company adjuster's job.

Company adjusters minimize your damage by encouraging cost savings methods.

1st Property Public Adjustment is your best line of defense. Do not accept less than what you are entitled to! 1st Property Public Adjustment will get you the highest possible settlement for all your insurance claims. Whether your property is residential, commercial, or a vacation property, We will negotiate the maximum settlement possible.